Self-employment shouldn't be a barrier to homeownership.

In Canada, nearly 2.9 million people have chosen the path of self-employment. These entrepreneurs, freelancers, consultants, and small business owners are creating their future with their own hands. They make enormous contributions to the Canadian economy, show initiative, and take risks. And what do they get in return?

Unfortunately, too often – mortgage application denials.

Most traditional lenders view self-employed borrowers as a "high-risk zone." They require perfect credit scores, years of documentation showing stable income, and often offer less favorable terms. Many entrepreneurs optimize their taxes, which puts them at a disadvantage when lenders use standard income assessment approaches.

But at IK Financial, we see things differently.

Why we say "yes" when others say "no".

At IK Financial, we provide personalized solutions for clients whose income isn't always fully reflected on their tax returns – but whose financial capacity is very real.

With over 15 years in the Canadian mortgage industry, we have exclusive access to specialized programs that account for the unique characteristics of self-employed businesses:

1. We don't just understand your income structure—we know how to present it.

Although tax planning is a legitimate business strategy, conventional lenders typically focus only on the perceived risks. At IK Financial, we deeply understand the balance between tax efficiency and qualifying for a mortgage.

Our expertise allows us to:

2. We create a customized mortgage strategy for your situation.

We don't just submit your documents to one bank and wait for a decision. Instead, we:

3. We have exclusive partnerships with alternative lenders offering reasonable rates.

Important note: alternative lenders in our case are not "lenders of last resort" with predatory terms. They are:

4. We look at the complete picture of your financial position.

Unlike banks with their template assessment forms, we analyze:

How self-employed individuals can secure mortgages of $1,000,000 and higher

Contrary to popular belief, self-employed borrowers can qualify for significant mortgage amounts. Here's what makes it possible:

1. Down payment is crucial

A down payment of 20-35% substantially reduces the lender's risk and opens access to specialized programs. This is your strongest card in mortgage negotiations.

2. Alternative documentation

Our lending partners accept:

3. Alternative Income Verification Programs

For entrepreneurs with good credit history and stable business, we offer access to Alternative Income Verification programs, where you can declare your actual income without the standard level of documentation. The key criteria here are your credit history and down payment.

Real success stories from our clients

💥 CASE 1: FROM DESPAIR TO DREAM HOME IN 9 DAYS

Who: Michael, a premium photographer and videographer working on projects with major corporate clients and high-end events.

Problem: He had been optimizing taxes for years, declaring minimal income. When he decided to purchase a home, he received rejections from three banks in a row. Other brokers told him to "forget about homeownership for at least 2 years."

Financial situation:

💥CASE 2: WHEN A NEW BUSINESS IS NOT A BARRIER

Who: Alexander, an IT consultant who launched his own business just 14 months ago, after 12 years of working for large IT companies.

Problem: Banks required a minimum of 2 years of tax history as self-employed. Real annual business turnover exceeded $200,000, but Alexander officially declared only $75,000, using legal tax optimization methods and writing off a significant portion of income as business expenses.

Financial situation:

💬 Objections we hear—and how we address them:

"My tax return shows insufficient income." We analyze your business, bank statements, contracts—and use them to build a real financial picture.

"I've already been denied by a bank." This only confirms that you've outgrown standard solutions. We work with those who think one step ahead.

"I'm afraid the rate will be too high." We select optimal conditions within the market situation—and always offer a strategy for gradual improvement of terms through refinancing.

We don't offer template solutions. We offer a path—from "impossible" to "keys in hand." If you're self-employed and can make a down payment of 20% or more—we'll help find a solution that matches your financial profile.

📩 Book a consultation. We'll analyze your situation and suggest options you can truly believe in.

IK Financial Mortgage Team operates on behalf of Mortgage Edge. Lic#10680

Follow Us on Social Media:

Instagram

Facebook

LinkedIn

YouTube

In Canada, nearly 2.9 million people have chosen the path of self-employment. These entrepreneurs, freelancers, consultants, and small business owners are creating their future with their own hands. They make enormous contributions to the Canadian economy, show initiative, and take risks. And what do they get in return?

Unfortunately, too often – mortgage application denials.

Most traditional lenders view self-employed borrowers as a "high-risk zone." They require perfect credit scores, years of documentation showing stable income, and often offer less favorable terms. Many entrepreneurs optimize their taxes, which puts them at a disadvantage when lenders use standard income assessment approaches.

But at IK Financial, we see things differently.

Why we say "yes" when others say "no".

At IK Financial, we provide personalized solutions for clients whose income isn't always fully reflected on their tax returns – but whose financial capacity is very real.

With over 15 years in the Canadian mortgage industry, we have exclusive access to specialized programs that account for the unique characteristics of self-employed businesses:

1. We don't just understand your income structure—we know how to present it.

Although tax planning is a legitimate business strategy, conventional lenders typically focus only on the perceived risks. At IK Financial, we deeply understand the balance between tax efficiency and qualifying for a mortgage.

Our expertise allows us to:

- Professionally structure your financial documents to meet lender requirements without misrepresenting information

- Highlight strengths in your financial picture that standard bank algorithms miss

- Properly present seasonal income fluctuations and business reinvestments as signs of stability, not risk

2. We create a customized mortgage strategy for your situation.

We don't just submit your documents to one bank and wait for a decision. Instead, we:

- Develop a comprehensive strategy considering all nuances of your financial situation

- Work through multiple scenarios and solution options before submitting an official application

- Determine the optimal ratio of down payment, mortgage term, and monthly payments specifically for your cash flow

- Pre-consult with potential lenders about possible solutions for your case

3. We have exclusive partnerships with alternative lenders offering reasonable rates.

Important note: alternative lenders in our case are not "lenders of last resort" with predatory terms. They are:

- Innovative financial companies with modern understanding of self-employed business processes

- Specialized lenders whose rates are only 0.5-1.5% higher than traditional bank rates—a difference easily offset by the tax advantages of self-employment

- Partners with whom we've established exclusive agreements for preferential terms specifically for IK Financial clients

- Financial organizations that value entrepreneurial potential and are willing to invest in long-term relationships

4. We look at the complete picture of your financial position.

Unlike banks with their template assessment forms, we analyze:

- The growth trajectory of your business, not just current metrics

- Growth potential of the industry where you operate

- Actual cash flow through your accounts, not just declared income

- Your business connections and client base stability

- Assets and investments that may not be reflected in standard forms

How self-employed individuals can secure mortgages of $1,000,000 and higher

Contrary to popular belief, self-employed borrowers can qualify for significant mortgage amounts. Here's what makes it possible:

1. Down payment is crucial

A down payment of 20-35% substantially reduces the lender's risk and opens access to specialized programs. This is your strongest card in mortgage negotiations.

2. Alternative documentation

Our lending partners accept:

- Bank statements demonstrating regular business transactions

- Client contracts confirming stable income sources

- Accounting reports showing actual cash flow

3. Alternative Income Verification Programs

For entrepreneurs with good credit history and stable business, we offer access to Alternative Income Verification programs, where you can declare your actual income without the standard level of documentation. The key criteria here are your credit history and down payment.

Real success stories from our clients

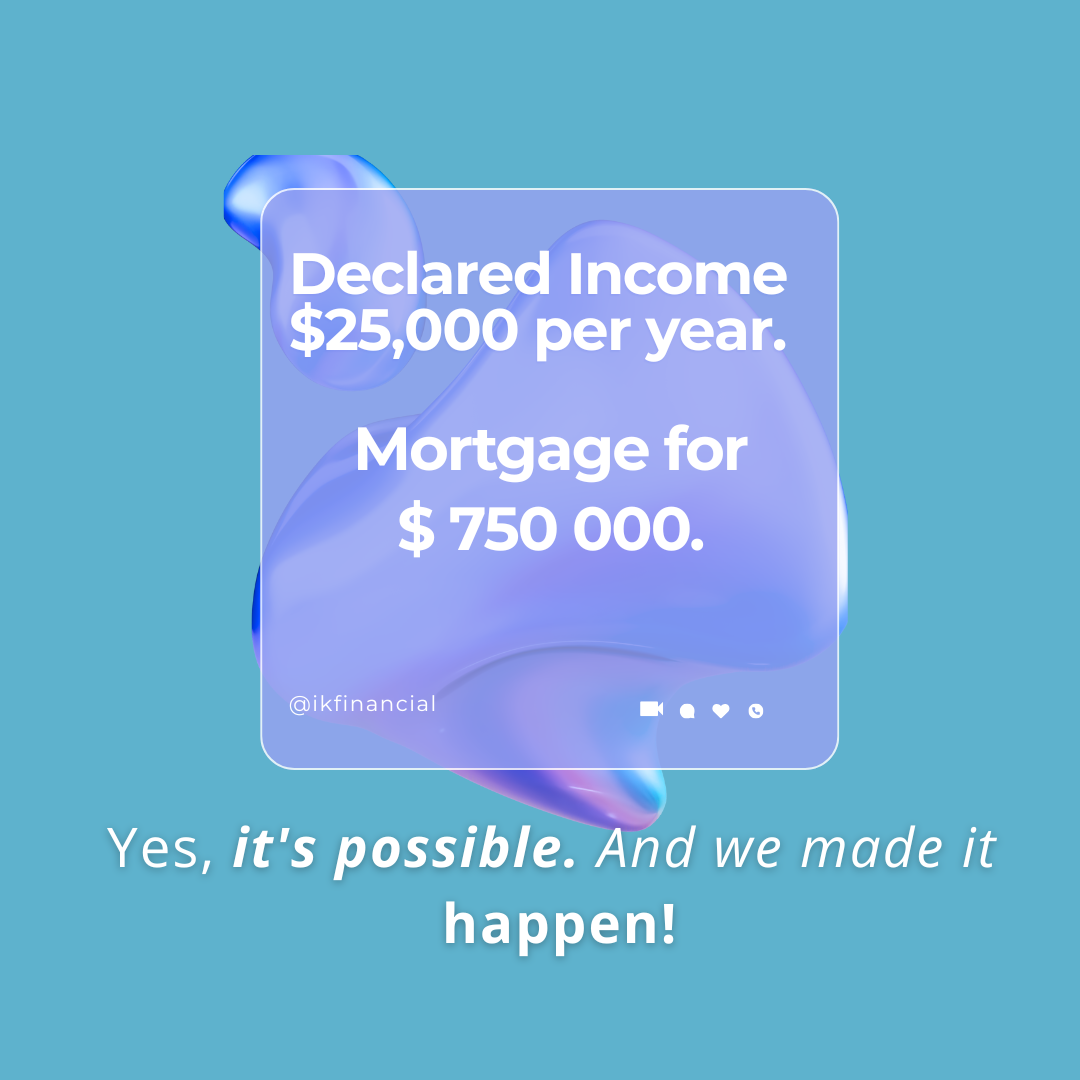

💥 CASE 1: FROM DESPAIR TO DREAM HOME IN 9 DAYS

Who: Michael, a premium photographer and videographer working on projects with major corporate clients and high-end events.

Problem: He had been optimizing taxes for years, declaring minimal income. When he decided to purchase a home, he received rejections from three banks in a row. Other brokers told him to "forget about homeownership for at least 2 years."

Financial situation:

- Declared annual income: only $25,000

- Actual turnover on bank statements: from $10,000/month

- Down payment: $300,000 (30%)

- Desired mortgage amount: $700,000

- Conducted detailed analysis of Michael's financial situation

- Structured bank statements, highlighting recurring deposits from regular clients

- Prepared a document package with evidence of business stability

- Utilized our privileged access to an alternative lender with expertise in digital industry professionals

- Approved: $750 000(more than initially requested!)

- Lender: Reliable alternative lender

- Rate: 4.99% (slightly higher than major banks)

- Term: 2 years

💥CASE 2: WHEN A NEW BUSINESS IS NOT A BARRIER

Who: Alexander, an IT consultant who launched his own business just 14 months ago, after 12 years of working for large IT companies.

Problem: Banks required a minimum of 2 years of tax history as self-employed. Real annual business turnover exceeded $200,000, but Alexander officially declared only $75,000, using legal tax optimization methods and writing off a significant portion of income as business expenses.

Financial situation:

- Declared income: $75,000

- Property value: $1,200,000

- Down payment: 25%

- Documentation issue: only one annual Notice of Assessment as self-employed

- Developed a comprehensive document package including corporate career history

- Provided clear instructions for preparing a business plan with consulting practice growth forecast

- Supplied copies of long-term client contracts as proof of stability

- Selected a specialized lender with understanding of the IT industry

- Approved: full mortgage amount without reduction

- Timeframe: the entire process took 12 days from initial consultation to approval

- Special terms: flexible prepayment options up to 20% of the original amount annually without penalties

💬 Objections we hear—and how we address them:

"My tax return shows insufficient income." We analyze your business, bank statements, contracts—and use them to build a real financial picture.

"I've already been denied by a bank." This only confirms that you've outgrown standard solutions. We work with those who think one step ahead.

"I'm afraid the rate will be too high." We select optimal conditions within the market situation—and always offer a strategy for gradual improvement of terms through refinancing.

We don't offer template solutions. We offer a path—from "impossible" to "keys in hand." If you're self-employed and can make a down payment of 20% or more—we'll help find a solution that matches your financial profile.

📩 Book a consultation. We'll analyze your situation and suggest options you can truly believe in.

IK Financial Mortgage Team operates on behalf of Mortgage Edge. Lic#10680

Follow Us on Social Media:

YouTube